TATA AIA

Best Term Life Insurance Services in Thrissur,Kerala

Welcome to Thrissur Kerala’s premier term life insurance services! We understand that safeguarding your family’s financial future is of utmost importance to you, and we are here to assist you every step of the way. Our reliable and comprehensive term insurance services are designed to provide you with peace of mind and ensure your loved ones are protected in the event of an unforeseen circumstance. You get a clear understanding of best term insurance services needs and their policies in Thrissur, Kerala on this page.

At ASSURED PLUS, we take pride in offering top-notch term insurance services to the residents of Thrissur, Kerala. Our policies are tailored to meet the unique needs of individuals and families, providing them with financial security and support during difficult times. Whether you’re just starting a family, planning for your children’s education, or securing your retirement, our policies can be customized to suit your specific requirements.

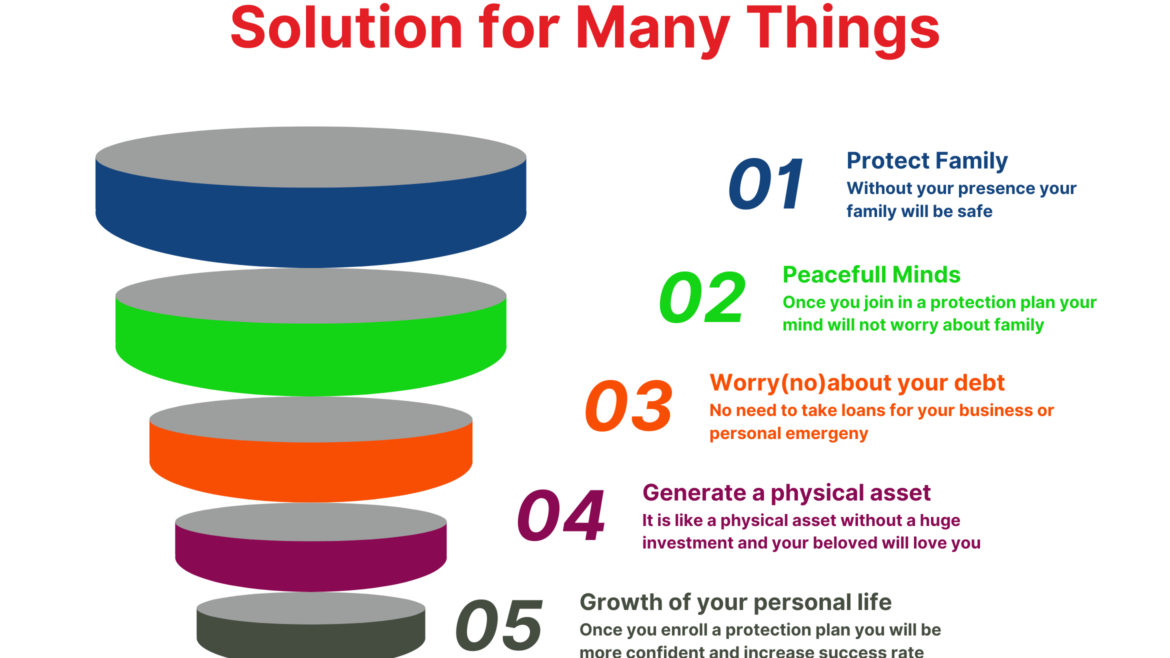

Why Choose Our Protection Insurance Services?

Financial Protection: Our life insurance policies offer a lump sum payment to your nominated beneficiaries in the event of your untimely demise. This payout can help cover outstanding debts, and mortgage payments, and provide financial stability for your family.

Eligiblities for Term Insurance Policy.

In India, the eligibility criteria for a protection plan, such as a life insurance policy, can vary depending on the specific insurer and policy you are considering. However, there are some general factors that typically influence eligibility. Here are a few common considerations:

- Age: Most insurance companies have minimum and maximum age limits for policyholders. The specific age ranges can vary, but generally, individuals between 18 and 65 years old are eligible for most protection plans.

- Health Condition: Insurance companies often require applicants to disclose their medical history and may request medical examinations or tests to assess their health condition. Certain pre-existing medical conditions or high-risk lifestyles may affect eligibility or result in higher premiums.

- Income: Some protection plans, such as income protection or disability insurance, may have income-related eligibility criteria. This ensures that the coverage aligns with an individual’s income and financial responsibilities.

- Occupation: Certain occupations considered to be high-risk may have specific eligibility requirements or may require additional riders or coverage. This is to account for the increased risk associated with those professions.

- Lifestyle Habits: Factors like smoking, alcohol consumption, and participation in hazardous activities can impact eligibility and premiums. Insurance companies typically consider these factors when assessing risk.

It’s important to note that these are general considerations, and the exact eligibility criteria can vary among insurers and policies. To obtain accurate and detailed information about eligibility for a specific protection plan in India, it is recommended to contact an insurance agent or broker. We are the Term Insurance advisor located in Thrissur Kerala will provide you with different company plans

Mutual Fund benefit + Term Plan Protection Coverage

Combining Protection Plan with ULIP Benefits:

In India, some insurance companies offer combination products that provide both term insurance and ULIP features. These policies are known as ULIPs with a term insurance rider or add-on. The term insurance rider provides additional life insurance coverage on top of the ULIP’s base coverage.

It’s important to carefully evaluate such products before considering them. We need to consider:

Cost: Combining term insurance with a ULIP may result in higher premiums compared to standalone term insurance policies. The cost of the term insurance rider is added to the premium for the ULIP component.

Flexibility: ULIPs generally have a lock-in period, during which the policyholder cannot withdraw the invested amount. If you opt for a combination product, the term insurance coverage is typically linked to the ULIP’s lock-in period. This means you may not be able to discontinue the term insurance component without surrendering the ULIP as well.

Returns: ULIPs are subject to market risks, as the investment component is linked to various funds. While there is a potential for returns, the actual performance of the investment is not guaranteed. It’s important to assess the historical performance and risk associated with ULIP’s funds before making a decision.

Before purchasing any insurance product, it is recommended to thoroughly understand the policy terms and conditions, compare different options available in the market, and seek advice from a financial advisor or insurance expert to ensure it aligns with your specific requirements and financial goals.

Criteria's for NRI's

- Eligibility Criteria for NRIs: To be eligible for a term life insurance policy in India as an NRI, you need to meet certain criteria. These may include:

- Citizenship of India or status as an Overseas Citizen of India

- A valid Indian passport

- Age within the prescribed limits set by the insurance provider

- Meeting the specific requirements of the insurance company regarding income, health, and lifestyle

- Key Features and Benefits: Term life insurance policies for NRIs come with several features and benefits tailored to meet their unique needs. Some of the key features include:

- Coverage in both India and abroad: These policies provide coverage regardless of your location, whether in India or abroad, giving you peace of mind wherever you are.

- Flexible premium payment options: Insurance providers offer various payment options, including online transfers, foreign currency payments, or through NRE/NRO accounts, making it convenient for NRIs to pay their premiums.

- Nomination and claim settlement: You can nominate your family members residing in India as beneficiaries of the policy. In case of a claim, the insurer will settle it in Indian currency, subject to necessary documentation.

- Documentation and Process: To apply for a term life insurance policy as an NRI, you will need to submit certain documents, such as:

- Proof of identity (passport, visa, or OCI card)

- Proof of address (Indian or overseas)

- Income documents (salary slips, bank statements, or tax returns)

- Medical reports (if required by the insurance provider)