Best Medical Insurance Services in Thrissur Kerala

Welcome to ASSURED PLUS, your trusted source for the best medical insurance services(We associate with TATA AIG) in Thrissur. We understand the importance of having comprehensive and best health insurance coverage services that meet your specific needs and provide financial security in times of medical emergencies. With our range of health insurance plans, we strive to offer you peace of mind and ensure that you and your loved ones receive the best medical insurance services without worrying about the financial burden.

Extensive Coverage: Our health insurance services have comprehensive coverage for a wide range of medical expenses, including hospitalization, surgeries, diagnostic tests, medication, and more.

Network of Hospitals: We have a strong network of reputable hospitals and healthcare providers in Thrissur, Kerala(All India 8000 and above). This allows you to avail of cashless hospitalization facilities, ensuring a hassle-free experience when you need medical treatment as cashless insurance services in Thrissur

Customized Plans: We believe in offering personalized solutions that cater to your specific requirements. Our health insurance plans can be customized to suit your budget, lifestyle, and medical needs. Whether you are an individual, a family, or a senior citizen, we have a plan that is tailored just for you.

Minimum Premium

Super Top-Up

Associate with TATA AIG

Super Top-Up Medical Insurance Services!

1. High Coverage Limits: Our Super Top Up Medical Insurance offers substantial coverage limits, surpassing your existing health insurance threshold. This means that once your primary health insurance coverage is exhausted, our policy will kick in to cover the additional expenses, saving you from significant financial burdens.

2. Flexibility of Sum Insured: We understand that every individual’s healthcare needs are unique. Therefore, we offer a range of sum-insured options, allowing you to choose the coverage that best suits your requirements and budget.

3. All-Round Coverage: The Super Top Up plan covers a wide range of medical expenses, including hospitalization costs, surgeries, doctor’s fees, diagnostics, and more. It ensures that you and your family receive comprehensive protection during times of medical emergencies.

4. No Medical Check-up: For existing policyholders with Tata AIG, availing of the Super Top Up Insurance is hassle-free as there is no requirement for any additional medical check-ups. It simplifies the process and ensures quick and seamless access to enhanced coverage.

5. Cashless Claims: We offer a cashless claim facility across a vast network of hospitals, making it convenient for you to avail of medical services without worrying about immediate out-of-pocket expenses.

Documents Required for Health Insurance Plans!

An individual or a family (total members up to 7)can join our TATA AIG policy without any age limit(start age 91 days). There are no medical checkups but must reveal all previous medical history if any. People who are above 45 need to attend our Tele-calling for medical verification purposes.

The details for the policy required;

Name & DOB

Relationship with proposer

Address

Height & Weight

Mail id & Mobil Phone Number

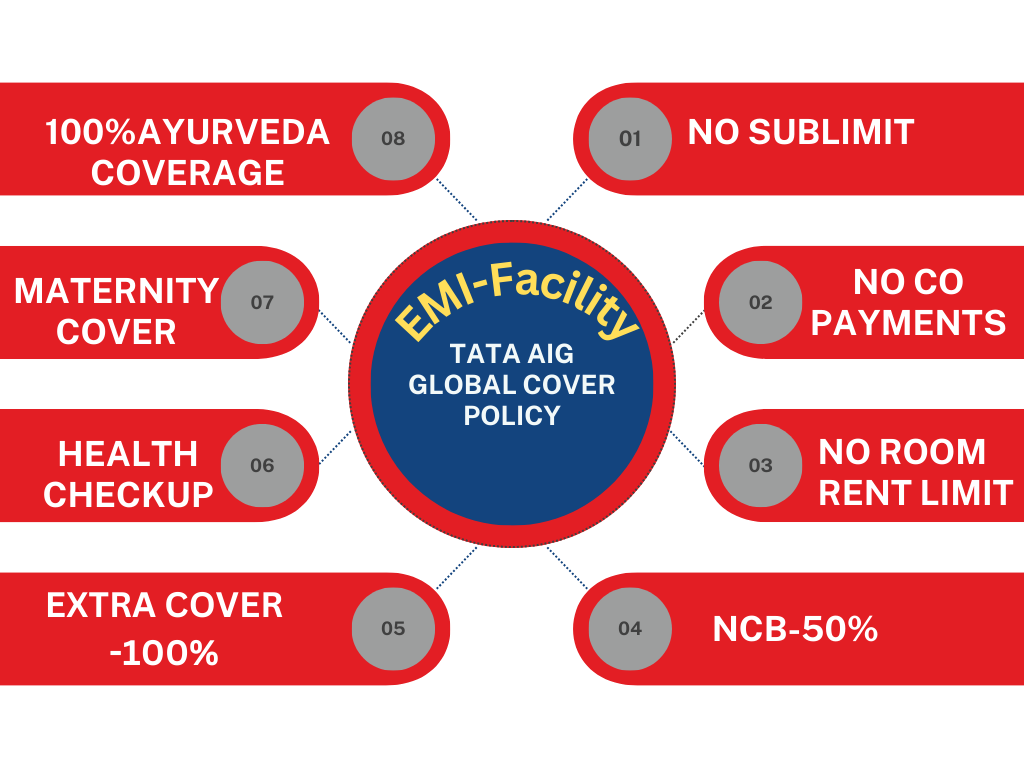

Features with Global Coverage

Health Insurance Plans

At ASSURED PLUS, we understand the importance of protecting your health and well-being. That’s why we offer a range of comprehensive health insurance plans designed to meet your individual needs.

Extensive Network: Our health insurance plans provide access to a wide network of healthcare providers, including doctors, specialists, hospitals, and clinics. You can choose from a diverse range of professionals and facilities to ensure you receive the care you need. Here we mention some other features below.

1)Global Coverage

2)No Sublimit or No Co-payments

3)No Room Limit

4)NCB-50%(upto100%)

5)Restoration 100%

6)Health Check-up

7)Maternity Cover(Limited Amount)

8)Air Ambulance

9)Many Over&Above Features

10)EMI Facility

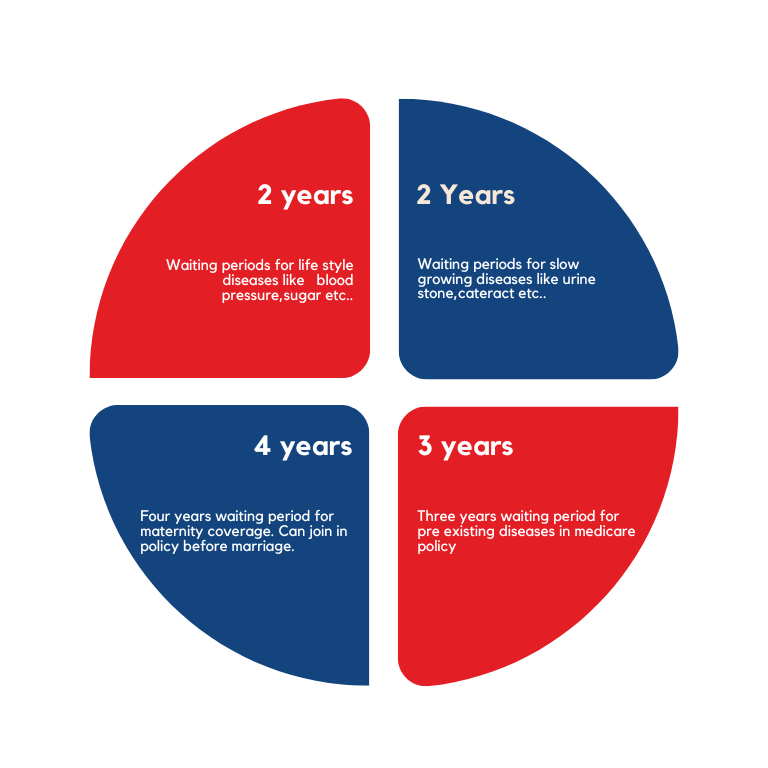

Waiting Periods Medical Insurance Services Rules

The primary purpose of a waiting period is to prevent people from buying medical insurance services only when they need immediate medical attention or for pre-existing conditions, which could lead to adverse selection and higher costs for the insurance provider.

Here are some common aspects related to waiting periods in health insurance Plans:

- Initial Waiting Period: This is the waiting period that typically occurs at the beginning of the insurance coverage, usually 30 days from the policy’s start date. During this time, the policyholder may not be able to claim benefits, except in cases of accidents or injuries.

- Pre-existing Conditions: Many health insurance plans have waiting periods for pre-existing conditions. These are medical conditions that the policyholder had before purchasing the insurance. The waiting period for pre-existing conditions can vary, but it is usually around 1 to 4 years. After the waiting period, the policyholder can make claims for treatments related to pre-existing conditions. We (TATA AIG) have two year waiting period for all pre-existing diseases.

- Specific Treatments: Some health insurance plans have waiting periods for specific treatments or procedures, such as maternity coverage or certain surgeries. These waiting periods can range from a few months to a year.

- New Policyholders: Waiting periods can also apply to new policyholders who have recently joined a health insurance plan.

- Renewal of Policy: In some cases, if the policyholder switches to a new health insurance plan or renews the existing plan, waiting periods may apply for certain benefits again, even if they were already covered in the previous policy.

Affordable Health Insurance Plans with EMI.

Network of Trusted Providers: We have established partnerships with a wide network of trusted healthcare providers, hospitals, and clinics. This allows us to offer you cost-effective insurance plans that cover a vast range of medical services and treatments, ensuring you receive quality care whenever you need it.

Transparent Pricing: At Affordable Health Insurance Service plans, we believe in transparency and honesty. Our pricing is straightforward, with no hidden fees or surprises. We will clearly outline the costs and benefits of each insurance plan, empowering you to make informed decisions that suit your budget.

Our speciality in EMI services are unique which are:

- 100% coverage once you start the policy after downpayment

- No deduction in claim bills from hospitals whether you have any EMI pending in premium

- Customers get EMI for renewal also if they have a good track record in first-year premium payment

- Get sufficient time to pay the amount without penalty