Investing in the right way in the right place through mutual funds can beat inflation better than any other investment, get a financial advisor for that.

Diversification and compounding returns through monthly mutual fund investment makes your investment more profitable.

A financial advisor facilitates your investment through mutual funds without the risk of the stock market & guide you for beautiful dividend plans.

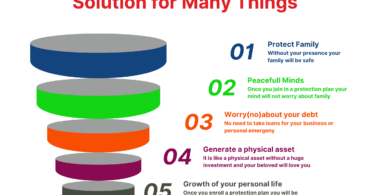

Your family is protected at the most affordable rates with this policy. In term insurance, you are able to get a large amount of life cover^ (i.e. sum assured) at a relatively low premium rate. In the event of the death of an insured during the policy term, the benefit amount is paid out to the nominee.

Loan servicing includes everything from disbursement of proceeds to loan repayment. You send monthly statements to note holders, collect monthly payments, keep records of payments and balances, collect and pay taxes, pay insurance, remit funds to note holders, and resolve delinquencies.

An insured person purchases health insurance to cover medical expenses if he or she gets ill or injured. Insurers cover hospitalization expenses, daycare procedures, critical illnesses, etc. People get global coverage plans and super top up plans.Top up plans are a boosters. We have different plans for seniors.