Become an Insurance Advisor

Welcome to our Health Insurance Advisor Job Benefits Page!

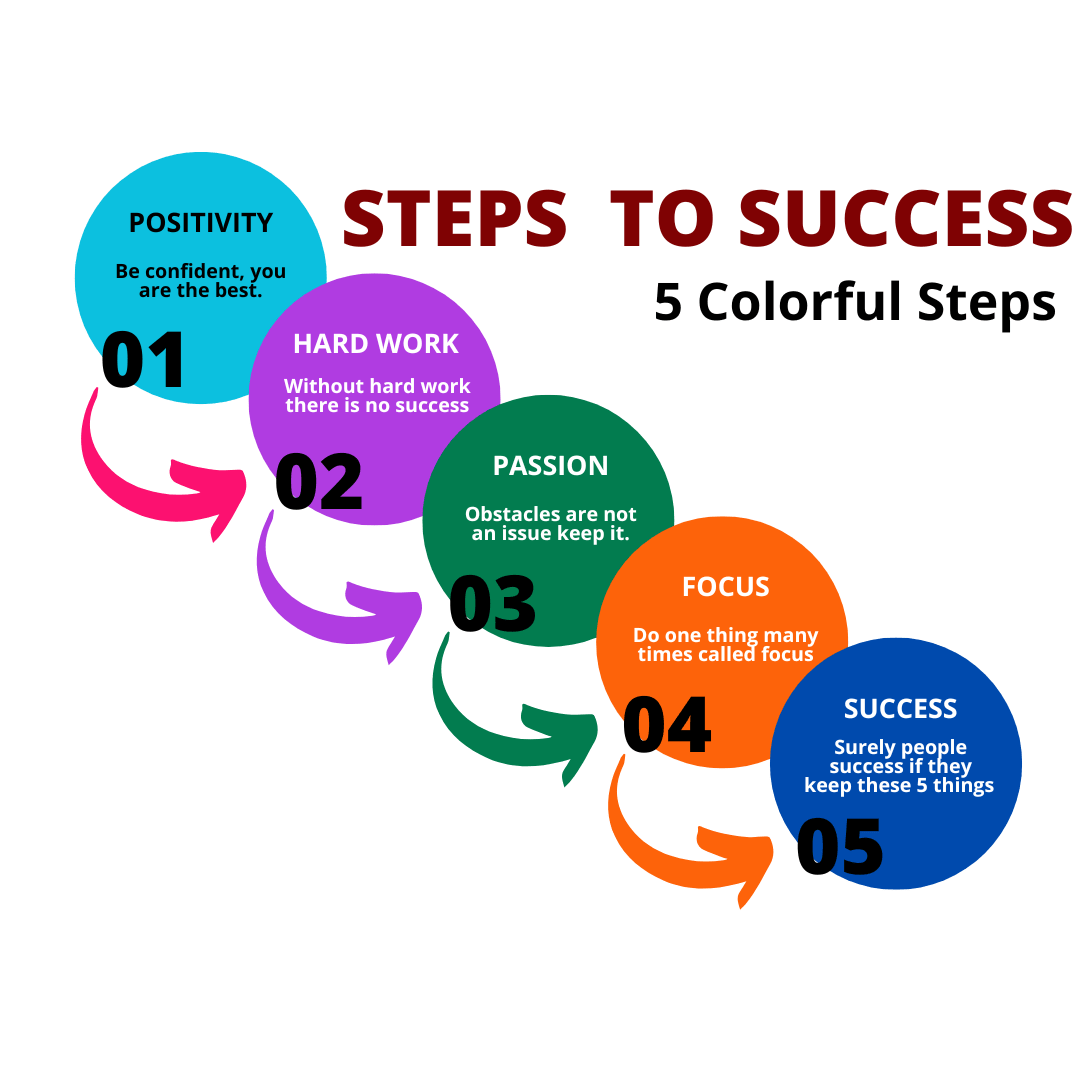

At ASSURED PLUS (Associate with TATA AIG), we value our insurance advisors and strive to provide a comprehensive benefits package that supports their health and well-being. As a Health Insurance Advisor, you play a crucial role in helping individuals and families navigate the complex world of health insurance. An insurance advisor job, it is most service-oriented and must be dedicated. How to be successful in an insurance advisor job is more important than how to be an insurance advisor. To ensure your success and satisfaction, we offer the following benefits:

Competitive Job: We believe your efforts are valuable and we are always ready to support you. As an Advisor, you will receive a competitive commission with your experience and skill set.

Paid Time Job: We believe in maintaining a healthy work-life balance. Our generous part-time job ensures that you have time to relax, recharge, and take care of personal matters. We offer tour packages, contexts, and high commissions to provide ample time for both work and personal commitments.

Professional Development: Continuous learning is crucial to staying ahead in the health insurance industry. We support your professional growth through various development programs, workshops, and opportunities to attend industry conferences and seminars. Expand your knowledge, enhance your skills, and advance your insurance advisor job with us.

No Target

Part Time Jobs in Thrissur

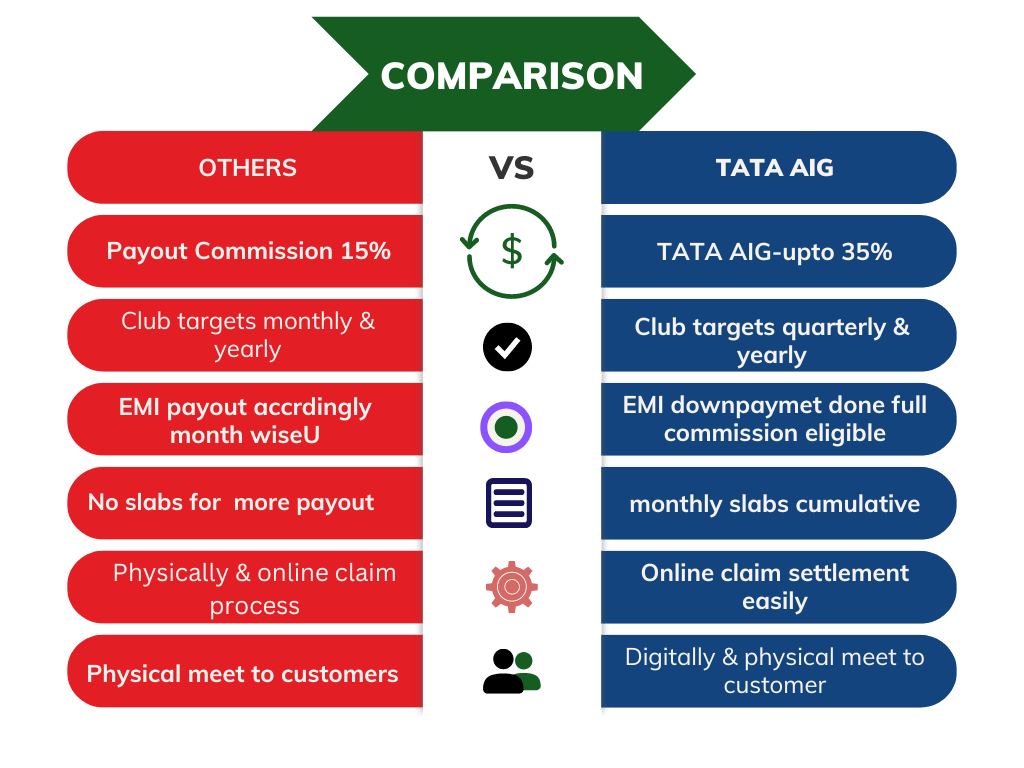

Welcome to our dedicated part-time jobs in Thrissur! If you’re looking for flexible employment opportunities that allow you to balance work and other commitments, you’ve come to the right place. Thrissur, a vibrant city in Kerala, offers a range of part-time job options across various industries, catering to students, homemakers, retirees, and individuals seeking additional income. Our platform connects job seekers with local businesses and organizations looking to hire part-time workers, making it easier than ever to find the perfect job that suits your schedule and interests. Explore our website, browse through the available listings, and take the first step towards your ideal part-time job in Thrissur today! Are you looking for advantages of part-time jobs in Thrissur specifically, or would you like me to provide general advantages of part-time jobs? The advantages of our Part time jobs in Thrissur as insurance advisor has many uniqueness and benefits that are different from other companies

- High Commission

- No Target

- Contexts for Business Achievements

- Best Product in Industry

- Sales Support

- Renewal Commission

- Training Support

- General Insurance Code

- EMI for Customers

- . Claim settlement transparency(TATA group direct)

General Insurance Code

Documents to become Health Insurance Advisor

Documents Required to Become Health Insurance Advisor:

1)Adhar Card

2)Pan Card

3)SSLC book Front Page & Mark List

4)Bank Passbook

5)Sign on a White Paper

6)Spouse Name & DOB

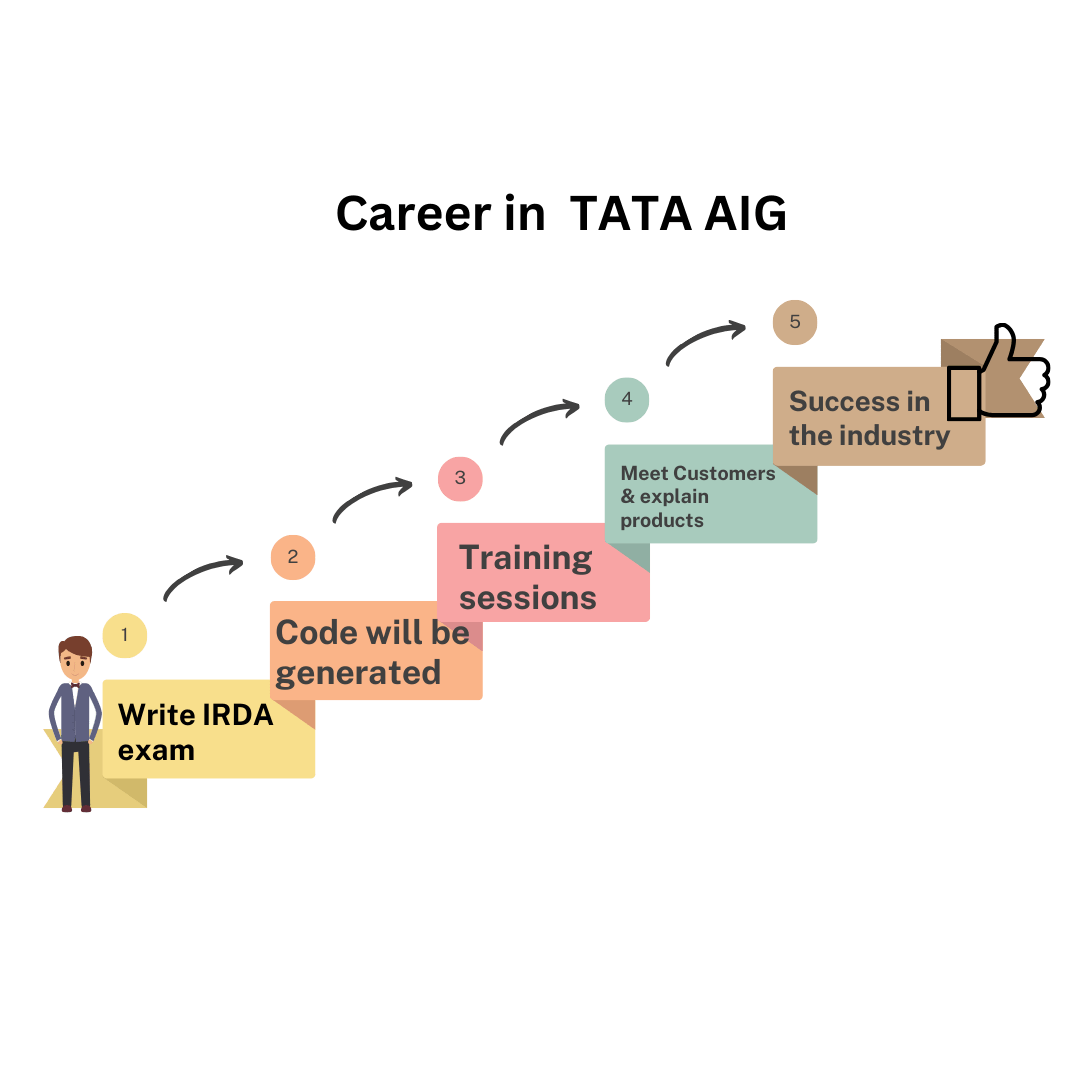

We recruit people for advisor jobs in TATA AIG General insurance company for their health insurance business development. After passing the exam(online IRDA exam), he/she can do all other insurances under the general insurance category is an additional benefit.

Are you passionate about helping people secure their health and financial well-being? Do you want to make a positive impact on individuals and families across India? As a health insurance advisor, you have the opportunity to do just that while building a successful and rewarding career for yourself.

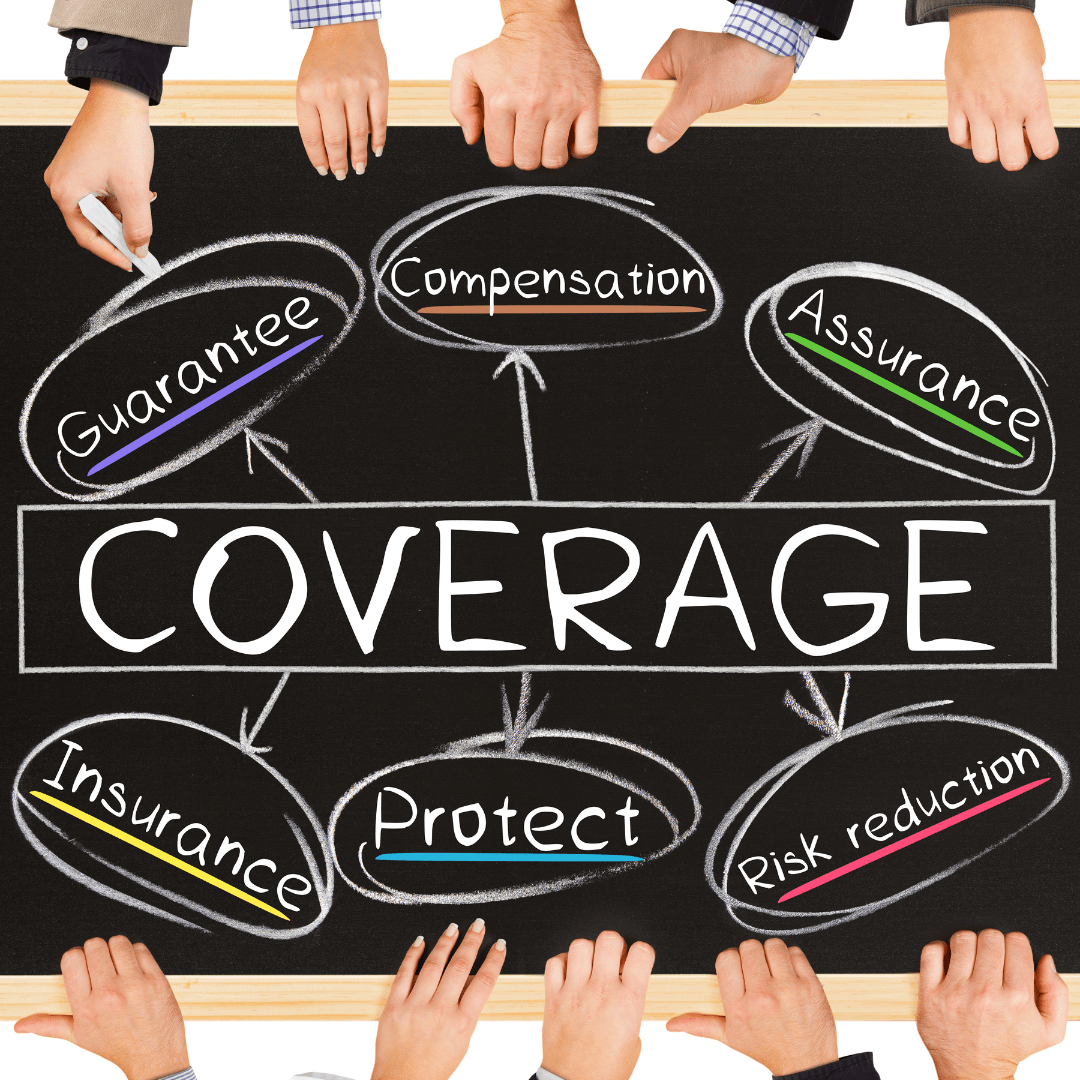

In India, the importance of health insurance has been steadily growing, with an increasing number of individuals recognizing the need for comprehensive coverage. The demand for health insurance policies has seen a significant rise, driven by rising healthcare costs, increasing awareness about the benefits of insurance, and a growing middle class.

Currently, health insurance coverage in India is steadily increasing, albeit with room for further expansion. The percentage of health insurance coverage in India was estimated to be around 35% of the total population. However, this statistic may have changed since then, and it would be advisable to refer to the latest official reports or industry sources for up-to-date figures.

As a health insurance advisor, you will play a crucial role in bridging the gap between individuals and appropriate health insurance plans. Your responsibilities will include:

- Understanding the unique needs and requirements of individuals or families seeking health insurance.

- Providing personalized guidance and advice on different health insurance policies available in the market.

- Helping clients navigate through the complexities of policy terms, coverage options, and claim procedures.

- Assisting clients in selecting the most suitable health insurance plan based on their budget and specific requirements.

- Ensuring a smooth application and enrollment process for clients.

- Building long-term relationships with clients by offering ongoing support and assistance with policy renewals, claim settlements, and any policy-related queries.

At our Health Insurance Advisor Opportunity, we offer comprehensive training and resources to help you succeed in this dynamic field. You will have access to a wide range of insurance products from reputable insurance providers, allowing you to offer tailored solutions to your clients.

Join us as a health insurance advisor and embark on a fulfilling career where you can make a real difference in people’s lives. Take advantage of this growing market and build a prosperous future for yourself while helping others safeguard their health and financial well-being.